Terms Of Service & Engagement

Created February 10, 2019 (unless otherwise indicated): Terms Of Service & Engagement for your business relationship with Harry Otto, Harry Otto Creative, LLC, White Plains Apostille & Mobile Notary, Corporate Apostille, Westchester Apostille and related entities (collectively referred to as “We,” “Us,” or “Our”).

Quick Links (Copy/Paste)

Use these links to jump to sections, or to send a vendor a direct URL to the controlling clause.

Master activation & notice

IMPORTANT:

By accepting payment, accepting any deposit, receiving consideration of any kind, or by storing or processing our payment credentials (credit card or banking information), you (the “Company” or “You”) agree to be bound by these Terms of Service. There are no opt-outs.

If you do not agree, you must terminate the business relationship and issue a full refund in the same manner the payment was received, and you are prohibited from charging, resubmitting charges, re-attempting payment, or retaining any stored payment credentials.

Separate from payment, you also acknowledge and agree that notice of these Terms may be delivered by electronic means (including email), certified mail, or verbal communication, and that your continued engagement with us after notice constitutes acceptance by performance as described in these Terms.

Email-alias notice / company-named address activation

To eliminate “we never saw the terms” arguments, we may deliver notice using a dedicated email alias that includes your company name in the address (for example: acme-agrees-to-terms-found@legal.harryotto.com). You agree that notice is effective when delivered by any of the channels defined in Assent & Notice, and that you may not defeat notice by refusing to click a link, by using a “no-reply” mailbox, or by placing internal routing rules on your own systems.

THIS AGREEMENT TAKES PRECEDENCE OVER ALL OTHER AGREEMENTS, WHETHER ORAL OR WRITTEN.

Consideration and Precedence under the Uniform Commercial Code:

This Agreement takes precedence upon any acceptance of consideration by any counterparty. Any pre-existing or subsequently updated “terms,” URL policies, clickwrap/browsewrap pages, or billing policies are null and void to the extent they conflict with this Agreement. Acceptance includes charges approved, payments received, services rendered, deposits accepted, or retention of our payment credentials.

Assent, Notice, and Activation

A. Who is covered

“Company” includes Harry Otto Creative, LLC and any subsidiaries, related entities, operating units, brand names, and personnel, including but not limited to White Plains Apostille & Mobile Notary, Corporate Apostille, White Plains Mobile Notary, and related entities. These Terms also apply to any person or entity that interacts with our personnel while doing business with any of our covered entities.

B. Notice methods that invoke these Terms

You agree that these Terms may be invoked and delivered by any of the following methods (each is independently sufficient):

- Electronic notice (email, SMS, messaging, hyperlinks) including direct URLs to section anchors on this page.

- Certified mail (USPS certified or equivalent), to your registered agent or principal address.

- Verbal notice delivered during a recorded call, including “the controlling terms are at legal.harryotto.com” and/or a section-specific URL.

You may not defeat notice by failing to open messages, by filtering messages, by using “no-reply” mailboxes, or by requiring a user to log into a third-party portal just to read a billing notice.

C. Acceptance by performance (no signature required)

After notice, acceptance occurs by performance, including (i) accepting any payment or deposit, (ii) processing our payment credentials, (iii) continuing to provide services, (iv) shipping goods, (v) continuing negotiations while demanding payment, or (vi) continuing contact with our personnel regarding a transaction.

D. Auto-renewals and recurring billing

Prior to any renewal, replenishment, recurring bill, or “auto-charge,” you must verify the current Terms at legal.harryotto.com. Acceptance of any payment constitutes renewal of these Terms as they exist at the time of payment.

Mandatory Recording, Saving, and Transcription of Calls

All calls, without exception, are recorded, saved, and transcribed. This requirement is never waived. We treat recordings and transcripts as business records and as written memorializations of communications “as if” reduced to writing.

Non-waivable condition

If any vendor or individual does not wish to be recorded, they must immediately cease further verbal communication and communicate only in writing. Any portion of the call that has already been recorded remains recorded, saved, cataloged, and treated like all other recorded calls.

Any statement by any person claiming a call “will not be recorded” is void and ineffective. Our systems do not support disabling recording for covered calls, and no employee, contractor, or agent has authority to waive this requirement.

If a dispute arises, the recordings and transcripts are admissible for internal dispute processing and may be used to verify and enforce the parties’ agreed terms, instructions, approvals, billing authorization limitations, and notice of these Terms.

Direct link:

https://legal.harryotto.com/#recording

Vendor Conduct Rules and Employee Protection

1. Zero-tolerance conduct rules

When interacting with any of our personnel, vendors and counterparties must maintain professional conduct. The following are prohibited:

- Threats, intimidation, coercion, or attempts to pressure staff into waiving documented procedures.

- Abusive language, harassment, discriminatory comments, or repeated hostile contact.

- Demands for off-platform or “unrecorded” calls, or demands that staff communicate outside recorded and logged channels.

- Retaliatory billing tactics (late fees on disputed amounts, collection threats during active disputes, or “damage” fees not tied to actual costs).

2. Immediate termination of engagement

Any violation permits us to immediately terminate the relationship, cancel authorizations, revoke payment privileges, refuse further service, and require written-only communication. Termination is effective upon notice by email, SMS, or recorded call.

3. Documentation & accountability

Because calls are recorded and transcribed, abusive conduct and coercive tactics are preserved as evidence of notice, refusal to comply, and the factual basis for termination and dispute resolution.

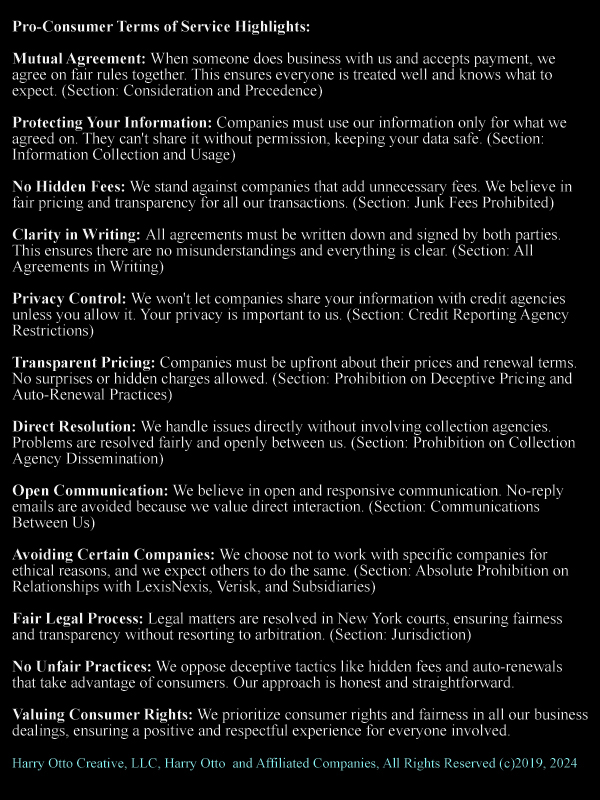

Terms of Service

This Terms of Service agreement (the “Agreement”) applies to any individual or entity (“Company”) that engages in business transactions with Us. This includes, without limitation: service providers, landlords, utilities, telecom, medical providers, insurers, tolling authorities, subscription vendors, charities we fund, and any other party that takes payment, processes credentials, or provides goods/services involving Us. By engaging in any dealings with Us after notice, You agree that this Agreement governs and supersedes conflicting terms you might claim apply.

When You do business with Us, YOU UNEQUIVOCALLY AGREE TO THIS TERMS OF SERVICE AGREEMENT, which means this Agreement is controlling. If there is ever a conflict between this Agreement and any other agreement, this one governs. There are no exceptions to this rule.

Information Collection and Usage

1.1 Limitations on Information Usage

Any company that collects information from Us, by any means, is strictly prohibited from using such information for any purpose other than providing the agreed-upon service. Under no circumstances shall this information be shared with third parties based on boilerplate terms. Any information-sharing requires a separate, paid information-sharing license from Us.

1.2 Activation of Agreement

If We sign or acknowledge any vendor agreement, these Terms are incorporated by reference and activated at that time. If the counterparty’s “boilerplate” cannot be modified, We will deliver these Terms by electronic notice and/or certified mail. Pending delivery, conflicts are resolved in favor of the party bearing the greater risk and exposure.

1.3 Communications Between Us

Both parties agree to avoid “no-reply” email practices. Messages designed to prevent replies, force portal logins, or require needless personal data are treated as phishing and may be filtered.

Companies are obligated to check the latest version of this Agreement at legal.harryotto.com prior to each recurring billing cycle or request for payment. Acceptance of any payment constitutes renewal of this Agreement as it exists at that time.

1.4 Prohibition on Collection Agency Dissemination

In the event of a disagreement, no information shall be disseminated to a collection agency. Recourse is limited to court proceedings in New York (state or federal). Collection agency involvement is prohibited.

1.5 Junk Fees Prohibited

We do not pay junk fees. Fees are unauthorized when they provide no real service value to the payer, are not tied to documented direct costs, or are used as coercive leverage during disputes.

Examples of unauthorized junk fees:

- Late fees on accounts actively in dispute.

- Fees to deactivate a device or subscription (a “switch-flip fee”).

- Fees assessed without reasonable advance written notice.

- Fees for sending someone to collections (prohibited here).

- Any fee solely to “protect the company’s interests” rather than provide a service.

1.6 Agreements in Writing; Recorded Calls Treated as Written

We require agreements in writing. For avoidance of doubt, recorded calls and their transcripts are treated as “in writing” for documenting notice, instructions, approvals, cancellations, disputes, and payment authorization limitations.

1.7 Credit Reporting Agency Restrictions

No information shall be reported to consumer or business credit reporting agencies without purchase of an additional credit information sharing license. This restriction applies similarly to data/information aggregators and brokers.

1.8 Data & Information Aggregators

You are prohibited from sharing any data with data aggregators or brokers without a separate written license naming each recipient.

- CLUE by LexisNexis & affiliates

- Arity

- Otonomo

- Wejo

- CARUSO

- TruView

- Truework

- The Work Number by Equifax

- CCC Verify

- Payscore

- Argyle

- Atomic

- GoodHire

- Truv

- Persona

- Powerlytics

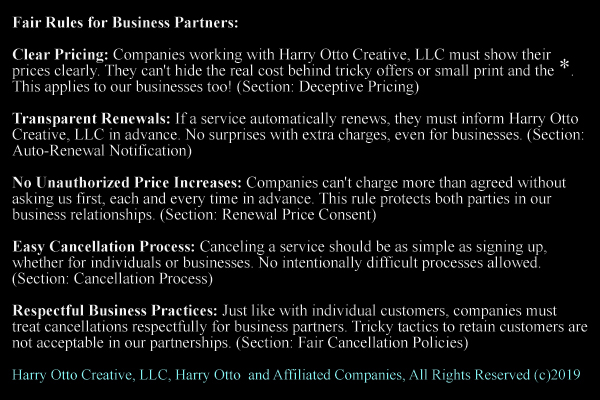

1.9 Prohibition on Deceptive Pricing and Auto-Renewal Practices

We prohibit deceptive “intro price then spike,” unclear renewal pricing, hidden terms, and cancellation friction. Vendors must provide advance written notice of renewal pricing and renewal dates, and must obtain express written consent for any material price increase.

Introductory pricing must clearly disclose renewal pricing and when it applies.

Auto-renewal requires advance written notice and must not be harder to cancel than to enroll.

No renewal price increase without express written consent.

Cancellation mechanisms must be no more burdensome than signup.

2.0 Medical Billing and Claim Submission Policy

2.1 Scope & Definitions

Company: Harry Otto Creative, LLC and its affiliates.

Team Member: Any employee or authorized representative of the Company.

Provider: Any licensed medical entity or professional submitting claims.

Insurer: Any third-party payor with which the Company maintains a contractual relationship.

Usual & Customary (U&C) Fee Schedule: Published regional fee guides for Westchester County, New York County, Wilmington DE, or prevailing U&C schedules in the provider’s locale.

2.2 Coverage & Payment Assistance

When a Team Member lacks eligibility under an Insurer plan, the Company may, at its sole discretion, process and pay claims in full or assist with larger claims.

No payment is ever guaranteed.

2.3 Claims Evaluation

Contracted Providers: Payment follows the in-force insurer/provider agreement.

Non-Contracted Providers: Absent a contract, reimbursement defaults to the applicable U&C schedule.

Out-of-State Services: Evaluated against that region’s U&C schedule.

No Guarantee of Payment: Claim submission does not guarantee payment.

2.4 Waivers & Pre-Authorization

The Company may require a signed waiver indemnifying the Team Member and the Company.

Waivers must be returned by an authorized representative prior to payment.

2.5 Balance & Split Billing Prohibited

BALANCE BILLING AND SPLIT BILLING CLAIMS ARE AUTOMATICALLY REJECTED AND ARE NOT CONSIDERED FOR APPEAL.

2.6 Duplicate & Excess Payments

If a Provider receives payment from an Insurer and then requests Company payment by “waiving” the Insurer, the Provider may not accept both reimbursements.

Once a Provider accepts payment exceeding prevailing U&C for a CPT code, further requests for that claim are permanently denied.

2.7 Appeal Process

Appeals must be in writing to medical.claim.appeals@legal.harryotto.com.

2.8 Submission Requirements & Compliance

All claims must include full CPT coding and itemized descriptions.

Incomplete submissions will be returned unprocessed.

2.9 Prohibited Billing Practices

The following practices are banned; claims flagged for these may be denied:

- Upcoding

- Unbundling

- Phantom Billing

- Duplicate Billing

- Invalid Modifier Use

- Chargemaster Abuse

- Retroactive Date Alterations

- ABN Misuse

- Stark Law Violations

- DRG Creep

- Balance Billing

- Split/Double Billing

THESE CLAIMS MAY BE DENIED AND MAY BE NON-APPEALABLE.

E-ZPass / MTA / PANYNJ / Similar Entities — Contract Overrides

Scope. Applies to MTA Bridges & Tunnels, NYS Thruway Authority, Port Authority of NY & NJ, E-ZPass-branded programs, and substantially similar providers.

Effective for our accounts and payments beginning August 9, 2025 at 8:00 AM ET, and thereafter on any renewal, replenishment, or continued use involving Us.

Assent. By accepting any consideration from Us (including deposits or processing payment credentials), you accept the overrides below. Where conflict exists, these terms govern.

The 10 Clauses We Reverse (with short reasons)

-

Unilateral “change anytime” provisions.

Override: No amendment applies to Us without prior, express written assent.

-

Total warranty disclaimers + full liability waivers + consumer indemnity.

Override: You remain responsible for system failures, misreads, misbilling, data errors, and negligence.

-

Vague “up to $50” administrative fees.

Override: Fees must be fixed, published, and tied to documented direct costs.

-

Open-ended auto-replenishment withdrawals.

Override: Hard caps apply unless we approve higher in writing.

-

Certified-mail returns and consumer-paid replacements for normal wear.

Override: Digital cancellation accepted; defective tags replaced free with reasonable return options.

-

One-way fee shifting for collection costs and attorneys’ fees.

Override: Each party bears its own fees absent a merits judgment awarding otherwise.

-

DMV registration leverage over small or contested sums.

Override: No DMV action absent a final, non-appealable court judgment authorizing it.

-

Privacy loopholes (“as permitted by law and policy”).

Override: No sharing beyond what is strictly necessary to post the toll, absent a separate opt-in license naming each recipient.

-

No interest on forced prepaid float plus unilateral “usage analysis” bumps.

Override: Excess balances refunded or credited promptly on request.

-

Short dispute windows and paid access to your own statements.

Override: Disputes allowed within 12 months; statements provided digitally at no charge within 10 business days.

Subdivision – Mobile App Hidden-Terms Prohibition

No illusory consent by link-to-nowhere.

Mandatory pre-display rule.

Anti self-judging clause.

Attorney-fee reversal.

Ban on absurd charges absent explicit statutory authority.

No retroactive changes without renewed explicit consent.

Geographic restriction rebuttal.

“Notice by silence” ban.

Procedural Notes & Enforcement

- Conflicts are resolved in favor of these overrides for any transaction involving Us.

- Any fee assessed contrary to this section is void and must be reversed within 10 business days of our notice.

- If a court trims any clause, the narrowest modification applies; the remainder stays in force.

Statutory and Case References

These references are provided for convenience and do not limit the scope of these Terms.

- New York call recording / eavesdropping definitions: NY Penal Law § 250.00 and § 250.05 (definitions and eavesdropping offense).

- New York consumer protection baseline: NY General Business Law § 349 (deceptive acts and practices).

- FAIR Business Practices Act (enacted 2025; effective 60 days after enactment): NYS Chapter 708 (2025) updating GBL Article 22-A / § 349 enforcement scope (AG authority re unfair/deceptive/abusive practices).

- Online-terms assent / inquiry notice (Second Circuit / NY): browsewrap/clickwrap cases including Meyer v. Uber and similar authorities; NY high court decisions applying “reasonably conspicuous notice” and assent principles.

Legal Provisions

Jurisdiction

This Agreement is governed by New York law. Any action arising out of or relating to this Agreement shall be brought exclusively in state or federal courts located in Westchester County, New York or New York City, New York. Where permitted, arbitration requirements and class action waivers asserted by counterparties are rejected and are void as applied to Us.

Entire Agreement

This Agreement constitutes the entire understanding between the parties, superseding prior agreements to the extent of conflict.

Severability

If any provision is found invalid or unenforceable, the remaining provisions remain in full force and effect.

Waiver

Failure to enforce any right or provision is not a waiver of that right or provision.

Updates and Modifications

We reserve the right to update these Terms. Updated terms may be delivered by electronic notice and/or certified mail. For recurring billing, counterparties must verify current terms prior to charging. Acceptance of payment renews these Terms as then in effect.

Contact Information

If you have questions, contact us:

Phone

Mailing Address

PO Box 144

White Plains, New York 10605

Website

By engaging in business transactions with Us after notice, You acknowledge that You have read, understood, and agreed to these Terms.

If you require a translated copy, we can provide this Agreement in other languages or read it over Zoom and provide a certified transcript.

FAQ Concerning This Agreement & Its Enforceability

Why does this agreement claim to supersede other contracts?

The intent is to require baseline fairness and clear notice in transactions, and to prevent hidden or one-sided terms from controlling after a counterparty has accepted consideration, processed credentials, or continued performance after notice.

What about sharing personal data with credit bureaus/information brokers?

Data sharing requires a separate paid license and explicit opt-in naming each recipient.

Why prohibit mandatory arbitration clauses?

We reject forced arbitration in adhesion contexts where it eliminates practical access to courts for disputes arising from vendor conduct.

What’s wrong with “no-reply” email?

It prevents communication, obstructs dispute resolution, and is treated as an unreliable notice mechanism.

These terms are intended to set minimum standards for transparency, good faith, and operational safety when interacting with our personnel.